All Pinnacle offices will be closed this Friday, July 4, in observance of Independence Day. See all federal bank holidays at PNFP.com/Holidays.

Six Reasons HSAs are a Great Benefit to Offer Employees

Because health savings accounts are tied to the ominously named “high-deductible health plan,” they sometimes get a bad rap. It doesn’t help that FSAs, which provide tax breaks and are typically available within any plan, and HSAs, which provide tax breaks and are only offered in combination with high-deductible plans, are often mixed up.

That’s really too bad, because HSAs offer a great many benefits to both employers and their employees.

They’re cutting-edge and great for millennials.

Many employers have moved to consumer-directed health plans to control premium costs while promoting smarter healthcare spending. According to the Kaiser Family Foundation, in 2018 a third of U.S.-based companies that provided health benefits offered high deductible health plans (HDHP). And enrollment in HSA-qualified plans has increased over the past five years, from 20% of covered workers in 2013 to 29% in 2018. With the adoption of the Affordable Care Act (ACA), many of our nation’s young adults are opting for higher deductible plans. These plans encourage employees to make informed decisions and spend wisely - which can lead to lower costs for the company.

They can be used for retirement.

Research shows half of millennials are worried about running out of money in retirement. And even though the percentage of Americans with HDHPs is nearly 50%, only half of those know their benefit package can be leveraged as a retirement tool. The lower premiums of an HDHP are suited to millennials’ budgets, and though deductibles are higher, millennials have comparatively lower usage of healthcare services than their elders. That can leave a lot of money left over. Since money in an HSA can be invested, HSAs are especially great for millennials who have many years for the investments to grow.

They’re affordable and portable.

What makes a high-deductible plan more attractive – to employer and employee alike – is the premium. HDHPs typically see a premium that’s much lower than preferred provider organization (PPO) plans. What’s more, when employees contribute to their HSAs pre-tax, the IRS doesn’t consider those contributions as wages. That means neither the employee nor the employer pays FICA taxes on them.

An HSA isn’t affected if an employee changes employers; his/her HSA follows him/her to the new employer. Once the money is deposited in the account, the money is the employee’s to save, use or invest. There is no expiration date, and the money can be passed on to beneficiaries upon death.

They increase engagement and control.

It’s true: HSAs make employees feel like they can control and manage their money the way they want to. Whether they’re using an HSA for a qualified medical expense or saving for retirement, they decide how and when to spend it. Offering an HSA gives employers a great opportunity to advise their employees on the best decisions for their wellness and financial well-being.

Many employees are familiar with flexible spending accounts (FSAs) and how they work, so it is important they understand the difference between an FSA and an HSA. Educating employees on the similarities and differences between an FSA and an HSA will help increase their awareness and engagement in utilizing the account.

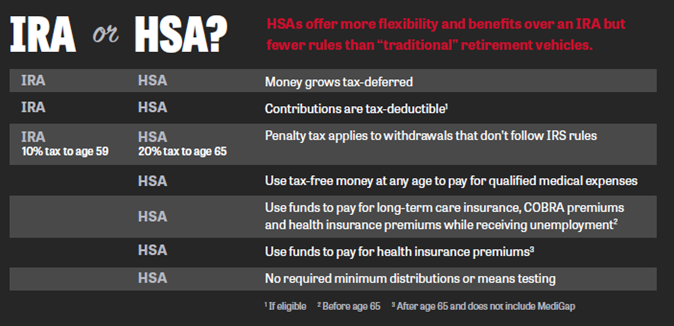

They’re an IRA in Disguise

Employees can contribute to their HSA and accrue interest just as they would an IRA. The triple tax advantages of HSAs lead the pack for why HSAs are a great bet for investment dollars: Account contributions are pre-tax or tax-deductible, and all earnings, interest and investment returns are tax-free. So are distributions, if they’re for a qualified medical expense. This is a great way to encourage employees to be financially strategic and healthy in their decisions this enrollment season.

Funds from an existing IRA can even be rolled over into an HSA. This is a once-in-a-lifetime option, but one to possibly consider when looking at the tax advantages of an HSA. The overall goal is to ensure the HSA complements the employee’s existing portfolio, including their 401(k).

They Drive Employee Retention

Lack of benefits is a major reason why employees leave jobs. And it takes more time and resources to attract a new employee than it does to retain a current one. That’s why it is more important now than ever to provide the best benefits possible to your existing employee base. Employer contributions to employee HSAs tend to increase their “stickiness” and decrease the chance that they will leave the company. Because HDHPs/HSAs can help your employees save money and invest for the future, they’re a great addition to any benefits package.

Mary Wettstein is an employer healthcare solutions advisor at Pinnacle Financial Partners. She can be reached at (615) 743-8873 or by email at Mary.Wettstein@pnfp.com.